EGBA report: UK gambling market booms as European GGR grows to £103.4bn

IMAGO

The European Gaming and Betting Association (EGBA) has revealed crucial findings in its FY2024 report, with figures released this week demonstrating that the European gambling market saw a 5% increase in gross gaming revenue (GGR) to £103.4bn.

Analysis of the continent’s figures comes as a direct result of a partnership between the EGBA and H2 Gaming Capital – the latter a renowned data intelligence firm.

Looking for 90-ball or 75-ball bingo? These best online bingo sites UK have it all!

The report, which includes data from the UK and EU member states, comprises several key points of interest on land-based and online gambling.

According to the report, online gambling revenue climbed to £40bn during FY2024, while land-based facilities improved by £63bn for the year.

These figures outline that, although online gambling continues to garner a significant audience, land-based gaming remains the market’s breadwinner. Yet, the internet-based vertical cut a slightly bigger slice of the overall market share – increasing its grip to 39%; a 2% boost over 2023.

On the other side of the coin, land-based gambling shed a small portion of its respective market share – with figures declining from 63% to 61%.

Unsurprisingly, mobile gambling revenue jumped to 58%, beating the 56% figure of FY2023. In a statement released by the EGBA, the group outlined that these figures reflected “evolving consumer preferences” as the industry steers further in the direction of digital products.

Lottery products accrued the greatest total revenue figure for the annum, at £31.75bn, with land-based purchases (£25.8bn) far outweighing online (£5.9bn).

Revenue for casino games achieved £25bn in FY2024 – but this branch of the market saw consumers act on their preference for online-focused content, with internet-based casino activity earning £17.9bn (71.6% of total revenue). On the contrary, land-based casino gaming took just £7.1bn (28.4%) of total revenue.

Notable figures for online sports and events betting proved consumers’ effervescent desire for on-the-go professional team and athlete wagering; the EGBA uncovered that internet sports gambling accounted for £11.44bn of the £16.79bn total.

Retail gaming machines raked £20.8bn throughout the fiscal year. By being land-based-only products, there is no online leg for this product type to compete with.

Geographic contrasts are at the fore of the EGBA’s reporting, with online gambling forming the majority of total revenue share in Sweden (68.3%), Finland (68.1%) and Denmark (68.1).

While bettors in northern Europe utilise online gambling facilities to a considerable degree, Spain’s internet-only vertical contributes only 14.2% of the nation’s gambling revenue.

Leading the charge in terms of revenue in the European gambling market is the UK (£25.7bn), followed by Italy (£21.3bn), France (14.87bn) and Germany (£14.86bn).

EGBA conclusions indicate that the 2025 gambling market should increase again to £106.67bn, with total online revenue (£42.68bn) and land-based earnings (£63.99bn) anticipated to grow steadily.

Secretary general of the EGBA, Maarten Haijer, discussed the group’s report following its release:

“Europe’s gambling market showed steady growth in 2024. While land-based gambling remains dominant, and continues to grow in absolute terms, online channels are showing stronger momentum, driven by changing consumer preferences and technological advancement.

Looking ahead to 2025, we expect online gambling to cross the significant 40% market share milestone, with this trend projected to continue in the coming years as online gambling is expected to approach parity with land-based gambling by 2029.”

Flutter revamps financial reporting strategy as US investment grows

Flutter revamps financial reporting strategy as US investment grows

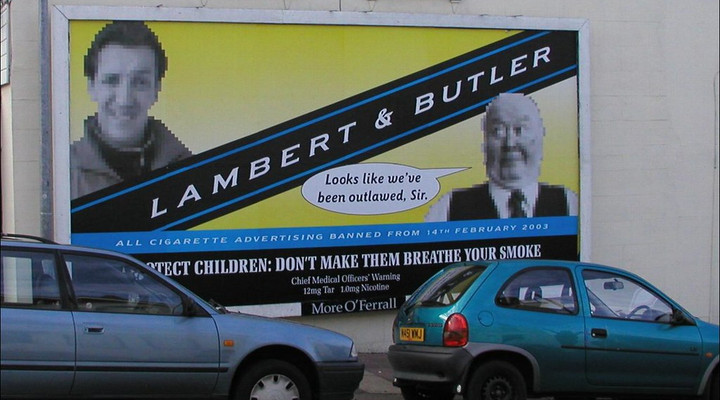

York's public health chief calls for gambling ads to be phased out like tobacco in UK

York's public health chief calls for gambling ads to be phased out like tobacco in UK

Thailand gambling legalisation: 80% of residents approve of gambling bill

Thailand gambling legalisation: 80% of residents approve of gambling bill