UK Government launched a consultation to ‘increase gambling tax’

The UK government announced on 28 April that they’ve launched a consultation into consolidating three gambling tax rates into one, industry-wide, rate.

HM Revenue & Customs and the treasury have proposed to consolidate the three-rate system into one single remote gambling tax called ‘Remote Betting & Gaming Duty’.

Thinking about playing blackjack for money? Try it online today!

Currently, there are three rates and they are a Remote Gaming Duty which is set at 21% of operator profit; General Betting Duty which is set at 15% of profit; and Pool Betting Duty (PBD), at 15% of net stake receipts.

Concerns in the industry suggest that the rate for the latter two will be increased by 6% to match the Remote Gaming Duty and so all tax rates in the industry will be at 21%.

Grainne Hurst, CEO of the Betting & Gaming Council, was less than impressed. He stated: “Any potential further increase in taxes on our members, so soon after a white paper which cost the sector over a billion pounds in lost revenue, will not raise more money for the treasury.”

Gambling consultant Steve Donoughue was equally as critical of the plans. He suggested an increase in tax might push players to the black market.

“Anyone who believes this will be seen as an opportunity by the cash-strapped treasury to revert all taxes back to the original idea of having practically all gambling taxes at 15%, is living in cloud cuckoo land,” Donoughue said.

“A decade ago the treasury said they believed you could tax online gambling as high as 29% without creating a black market, so the new rate could be up as high as that.”

However, newly-appointed CEO of Entain Stella David calmed fears and stated the industry will be putting their case forward during the consultation process.

"There's all sorts of legislation that would have to change to enable the harmonisation which means that the earliest we perceive there would be some change, whatever way it would be, would be late 2027, early 2028;” stated David.

"There’s a huge amount of things that can happen between now and then and clearly the industry will be putting its point of view through as part of that journey. It’s really early days but nothing is going to happen in the immediate short term."

The consultation process will last 12 weeks and end on 21 July. It remains to be seen whether the tax-hike will be announced in the autumn budget. If so, the UK industry can expect a hit on profits in years to come.

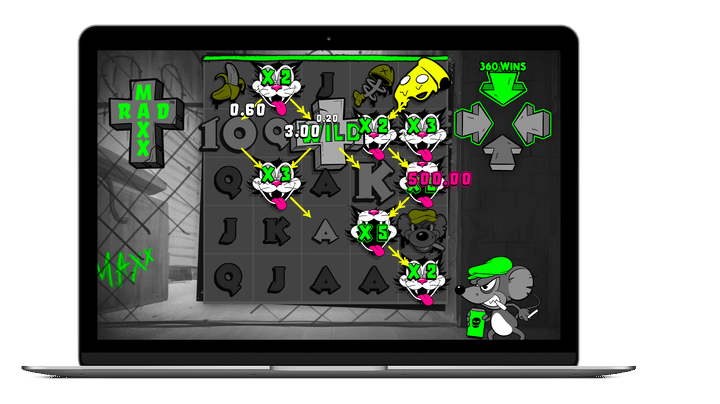

Hacksaw Gaming launches Rad Maxx online slot to the UK market

Hacksaw Gaming launches Rad Maxx online slot to the UK market

Flutter details three-point plan as firm completes purchase of Playtech subsidiary Snaitech

Flutter details three-point plan as firm completes purchase of Playtech subsidiary Snaitech

Thai analysis demonstrates reliance on proposed casino infrastructure

Thai analysis demonstrates reliance on proposed casino infrastructure