UK Gambling Commission found making 'secret deals' with betting companies to avoid formal action

IMAGO

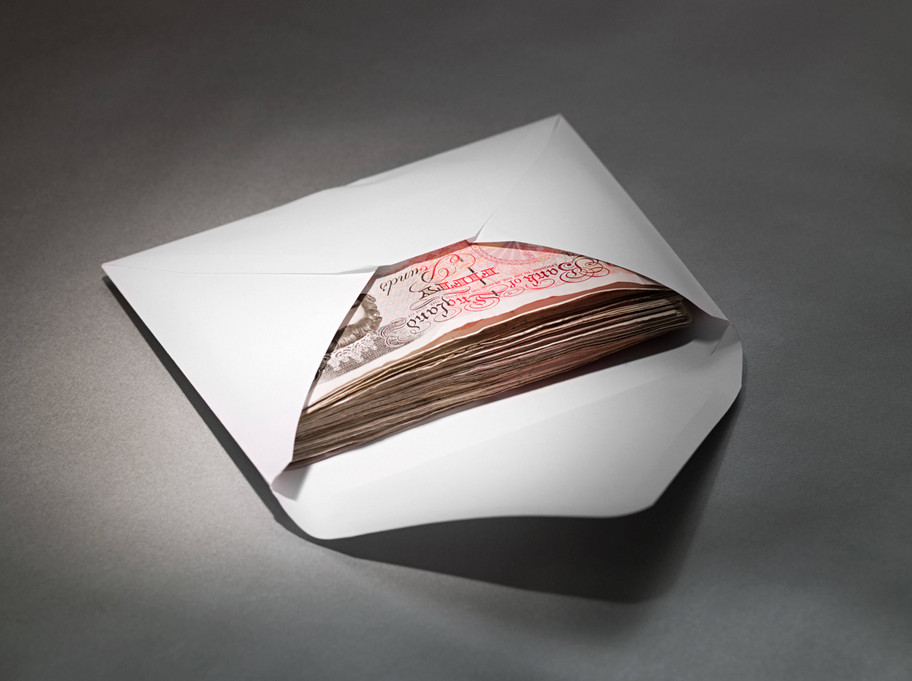

Betting companies in the United Kingdom have reportedly been making side deals with the UK Gambling Commission (UKGC), including 'secret revenue penalties' to avoid failings being made public.

The information has been revealed following an investigation by The Observer newspaper.

It was found that the commission has been placing betting firms into special measures, with the loophole finding a mutual agreement to avoid official formal action.

Strict punishment could include severe financial penalties or the suspension of an operating licence, but instead, companies have been “divesting any profit” made from regulatory breaches and agreeing to an action plan to avoid repeats in the future.

The situation appears to undermine the important role of the gambling regulator and the need for transparency, but the scrutiny has increased following a legal claim filed in the High Court last week.

Annie Ashton took action against the British regulator after her husband, Luke, took his own life due to a gambling addiction.

An inquest found Betfair had failed in its duty of care and did not identify Luke as a problem gambler.

The Entain-owned brand was put into special measures at the time of Mr Ashton’s passing in April 2021, but this only came to light when the inquest concluded, in 2023.

Betfair’s failures included an insufficient process to identify customers at risk of serious gambling harm, while the company had moved £635,123 to charities working to eradicate problem gambling.

This meant Betfair avoided official regulatory action, but campaigners such as Ms Ashton are demanding further action. They feel the current arrangement forms a “protective bubble” for betting operators who are putting users at risk.

Annie Ashton has implored the regulator to publish the number of firms it has put into special measures, as well as naming them and the amount of revenues surrendered. This information should be public knowledge and it should be scrutinised.

“In Luke’s case, we now know Betfair was in special measures and the regulator should have been looking at them with even more scrutiny. Someone died under their watch.

“The whole situation with Luke was completely avoidable when you start unpicking what happened. You start to see these errors allowing for deaths to occur and lessons are not being learned at all,” she added.

The UKGC has defended the special measures tactics as an effective tool to derive swift action from operators, just short of taking formal regulatory action, but it undoubtedly creates ambiguity without transparency, especially when it comes to casino sites in the UK.

The inquest into Mr Ashton’s death found his compulsive gambling activity was a contributory factor but Betfair’s system had only flagged him as “low risk”.

The deposits and losses recorded by Ashton intensified in the weeks leading up to his death, but this only resulted in “safer gambling” emails being sent. If anything, his risky betting activity was being rewarded with free bets and bonus incentives, according to Ms Ashton’s legal team.

The UKGC has defended the special measures tactics as an effective tool to derive swift action from operators, just short of taking formal regulatory action, but it undoubtedly creates ambiguity without transparency.

Such secret deals and favourable outcomes for betting companies will remain contentious, especially in cases like the tragic passing of Mr Ashton.

To learn more, visit our responsible gambling at casinos page which also offers resources and advice on where to seek help if needed.

Entain Australia CEO Lachlan Fitt is the third exec to quit following AUSTRAC investigation

Entain Australia CEO Lachlan Fitt is the third exec to quit following AUSTRAC investigation

Swintt expands into the UK following new partnership with MrQ casino

Swintt expands into the UK following new partnership with MrQ casino

Merkur Slots UK fined almost £100,000 for exploiting vulnerable customer

Merkur Slots UK fined almost £100,000 for exploiting vulnerable customer